Transparency

Where does your money go

Credibility is one of the basic pillars on which the work of ALBOAN NGOs is based. Pillar that sustains the necessary legitimacy to publicly denounce situations of injustice and on which the trust is based that allows many people and entities to be linked to our organizations. Aware of all this and assuming the responsibility that our activity entails, since the birth of ALBOAN we were clear about our option to use tools to externally evaluate our work and thus be able to render accounts transparently to citizens.

"Credibility is one of the basic pillars on which the work of the ALBOAN NGOs is based"

Clear accounts

At ALBOAN we are clear about our option to use tools to externally evaluate our work and thus be able to be accountable in a transparent manner to citizens.

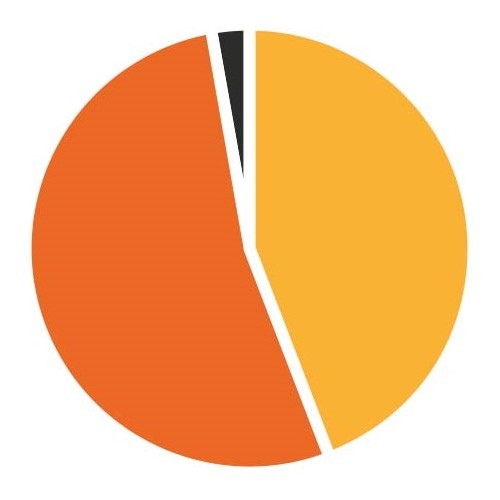

Origin of income in 2024

Public

6.043.849€

Private

4.124.338€

Others

546.122€

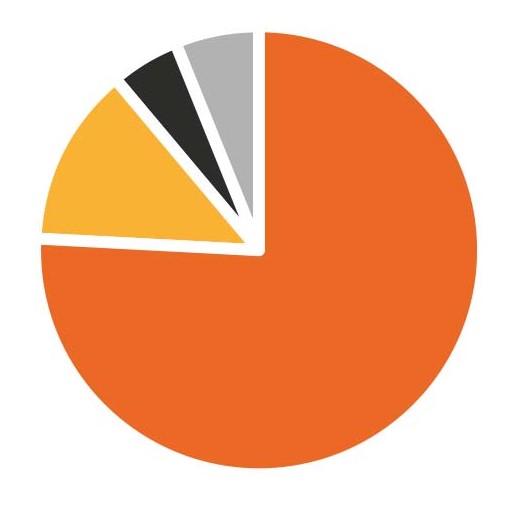

Expenses by Areas 2024

International Cooperation

76%

Public Action and Participation

11%

Communication

6%

Management

6%

People

2%

Expenditures in Cooperation by sectors 2024

Education

24%

Gender

24%

Socio-environmental Justice

23%

Human mobility

15%

Strengthening civil society

14%

Expenditures in Cooperation by geographical area 2024

Latin America

47%

Africa

32%

Asia

19%

Europe

2%

Evolution of contributions (2021-2024)

2024

10.714.309€

2023

9.874.943€

2022

10.246.561€

2021

10.034.167€

Taxation

The tax deductions to be applied for economic collaborations with Alboan vary depending on the place of residence and the type of person (natural or legal).

Individuals (IRPF)*

The first 250 euros of donation will be deducted at 80%. The amount exceeding €250 will be deducted at 40%.

A partir del 3er año de donaciones consecutivas, los primeros 250 euros de donativo se deducirán al 80% y la cantidad que exceda de los 250€ se deducirá al 45%, siempre y cuando la donación sea igual o superior a las donaciones hechas los dos años anteriores.

Legal Entities (Corporate Tax)*

40% de deducción en la cuota íntegra// 45% de deducción en la cuota íntegra, siempre y cuando la donación sea igual o superior a las donaciones hechas los dos años anteriores.

Regulations

Law 49/2002

Art. 19 IRPF (modification that applies from January 1, 2020 note from the tax agency)

Art. 20 I. Companies)

Individuals (IRPF)*

45% deduction in full installment

Legal Entities (Corporate Tax)*

45% deduction in liquid installment

Regulations

Foral regulation 35/2021 Art.31

DECLARED PRIORITY ACTIVITY 2022 (by reciprocity with Diputación Foral de Gipuzkoa)

Individuals (IRPF)*

45% deduction in full installment

Legal Entities (Corporate Tax)*

45% deduction in liquid installment

Regulations

Foral Regulation 3/2019 Art.42 Priority activity

DECLARED A PRIORITY ACTIVITY for fiscal 2022

Individuals (IRPF)*

30% deduction in total quota

Legal Entities (Corporate Tax)*

Deductible expense for taxable income

18% deduction in net quota

Regulations

Foral Regulation 3/2004 Art.29

DECLARED A PRIORITY ACTIVITY for fiscal 2022

Deductions are subject to limitations. Consult regulations.